Table of Contents

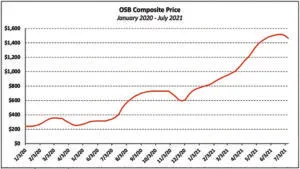

After reaching historic highs in June, the price of OSB began to drop through the summer, at one point plunging several hundred dollars in a single week.

Through the end of the summer the fast-falling prices have frozen many buyers, afraid the drop will continue. Yet with customers remaining active, purchasers can’t wait too long. “Business is still crazy, although buyers are holding off when they can to let prices settle in,” explained Langboard’s Chuck Rigoni. “Most can’t hold off much though, as their customers are so busy. We believe there is still very real demand in place, and business should be good through 2022, although with the virus and other uncertainties anything could happen.”

In one sense, OSB prices “returning to earth” was as inevitable as gravity. According to the National Association of Home Builders, the average mill price of OSB increased 510% over 18 months, outpacing the spike in lumber prices by 180 percentage points. NAHB reported that prices for certain OSB items in certain markets rose even more. Reportedly, the delivered price of 3/8” thick OSB sheathing in Portland, Or., skyrocketed an astounding 662% from Janauary 2020 to June 2021.

OSB has grown to be the product of choice for most structural panel applications in new construction, outproducing plywood by a margin of two to one. Yet there are far fewer OSB mills than lumber mills, so the product is more susceptible to shortages when construction activity takes off.

As well, offered one analyst, the OSB industry has a large number of mill that “are somewhat long in the tooth, so more maintenance downtime is needed to keep them running.”

Those issues are gradually changing. Several new mega-capacity, state-of-the-art facilities have been added over the last few years.

This past spring, West Fraser restarted a long-idled OSB plant in Quebec, and RoyOMartin increased production capacity at its mill in Texas.

As well, later this year Lousiana-Pacific will restart its Peace Valley operation in British Columbia after a top-to-bottom overhaul, and RoyOMartin will begin construction on a second OSB mill in Corrigan, Tx. Next summer Huber Engineered Woods will start up a huge, high-capacity plant in Minnesota.

OSB production during the first six months of 2021 totaled 11.9 billion sq. ft., a 7.1% increase over the first half of 2020. With the expectation for healthy demand to continue and the promise of increased production going forward, hopefully less volatility is in store for OSB markets.